Market Commentary – August 5th, 2024

Week in Review…

Broad equity markets finished sharply lower for the week with renewed fears of a recession looming.

- The S&P 500 was down 2.06%

- The Dow Jones Industrial Average declined by 2.10%

- The Nasdaq Composite was lower by 3.35%

- The 10-Year Treasury closed at 3.80%

The Consumer Confidence Index for the month of July was released on Tuesday by the Conference Board. This is now the third consecutive reading indicating solid confidence in the economy. That same day, the American Petroleum Institute (API) released their Weekly Crude Oil Stock measurement. The weekly reading showed a significant decrease in inventories, indicating an increase in the demand for oil.

Midway through the week, the ADP’s employment report helped to gauge the health of the labor market ahead of the upcoming Federal Open Market Committee (FOMC) meeting. Since June 2024, there has been a decreasing trend in the non-farm, private, payroll data, indicating a worsening market. Additionally, the Job Openings and Labor Turnover Survey (JOLTS) job openings report was released, showing 8.184 million job vacancies in the month of June. This is an increase of 40,000 openings from the previous reading.

The week concluded with the spotlight on the Federal Reserve providing consumers with updates on inflation and the possibility of rate cuts this year. During the meeting, it was indicated that their target range will be kept steady at 5.25%-5.50% but hinted at a possible rate cut in September. Additionally, the Fed’s statement noted job gains have moderated and the Fed now sees risks to both sides of its mandate, suggesting a shift from a sole focus on inflation to also addressing potential labor market weaknesses. Expectations for a rate cut in September remain high.

Spotlight

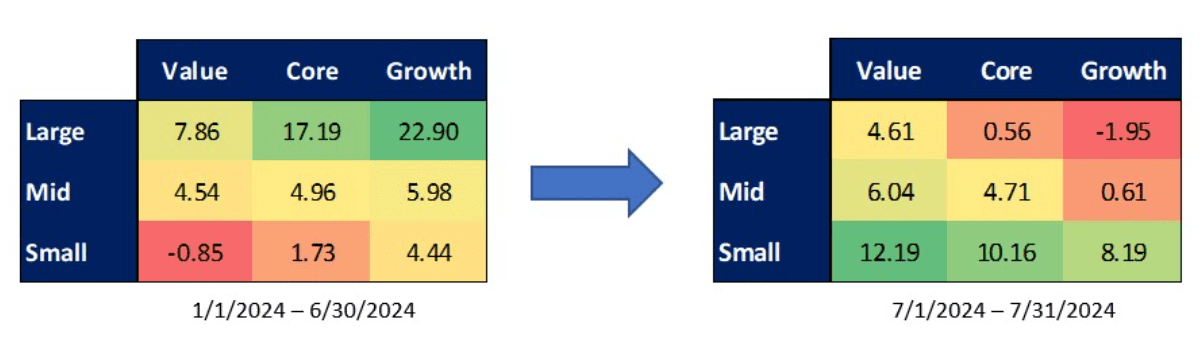

Equity Market Rotation

Equity markets experienced a sharp rotation in the month of July. In the first half of the year, large cap equities dominated their small cap counterparts with the Russell 1000 index outperforming the Russell 2000 index by 15.46%. That trend reversed abruptly in the month of July, with the Russell 2000 index outperforming the Russell 1000 index by 9.6% in just one month.

Some of this outperformance can be attributed to the soft-landing narrative again taking center stage. Investors believe that the market is moving into a “Goldilocks” scenario where inflation is decelerating and economic growth is moderating. This scenario gives the Federal Reserve confidence that inflation is sustainably dropping to their 2% goal and that rates will come down sooner rather than later.

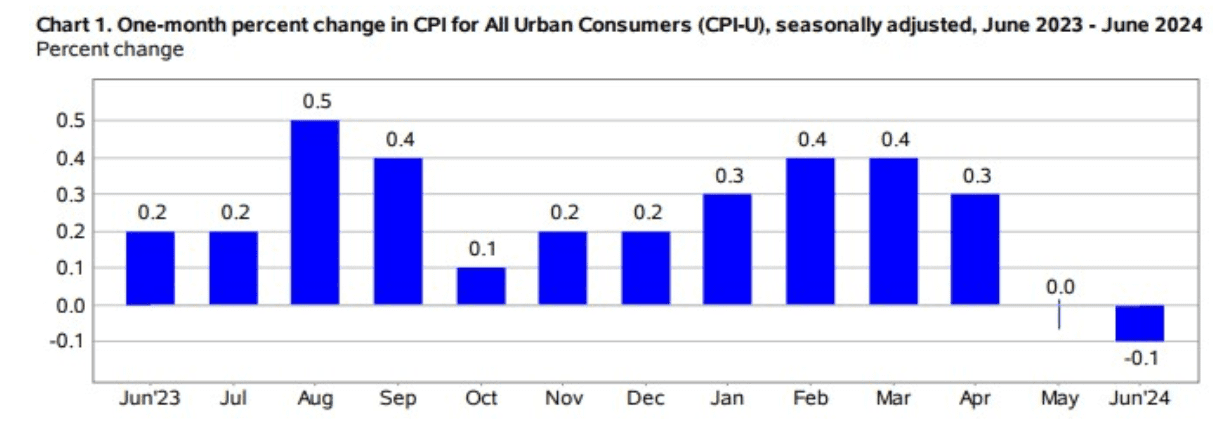

The Labor Department released their Consumer Price Index (CPI) report halfway through the month. The report was better-than-expected and showed a 0.1% decline from May to June. This was the first month-over-month decline since 2020. The report also showed a significant decline in rent and homeownership costs, which had remained persistently high.

Source: U.S. Bureau of Labor Statistics

Fed chairman Jerome Powell said during an interview at the Economic Club of Washington that, “We didn’t gain any additional confidence in the first quarter, but the three readings in the second quarter, including the one from last week, do add somewhat to confidence” that inflation is moving toward the Fed’s 2% target.

Moderating inflation was received with optimism. The market was pricing in a 100% probability of a rate cut in September. Interest rates tend to be negatively correlated with equity valuations and the news was especially beneficial for small cap equities. Smaller companies tend to outperform as monetary policy loosens and economic activity is stimulated.

One reason why this asset class tends to outperform in this landscape is because small cap equities have three times the debt burden of their large cap counterparts, as measured by net debt divided by earnings before interest, taxes, depreciation, and amortization (EBITDA). Not only are small cap equities more levered, but roughly 45% of companies in the Russell 2000 issue floating rate debt versus just 9% for the S&P 500. Interest rates declining mean a lesser debt burden and a way to grow and scale their businesses.

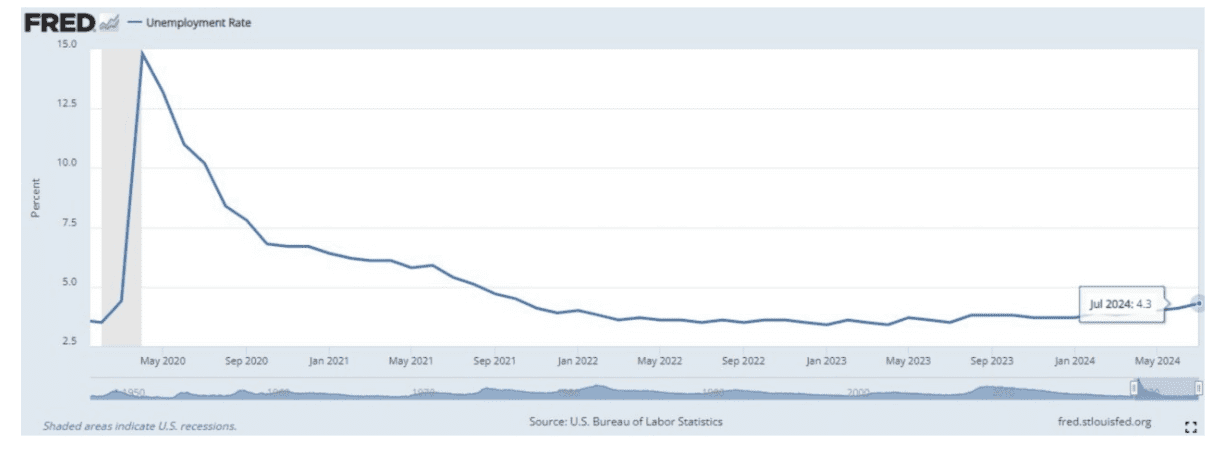

One area of concern remains in the labor market. This area is important because the Fed has a dual mandate to maximize employment in the U.S. while maintaining price stability. Fed Chair Powell has made it clear that the central bank is focusing more on the labor side of that mandate as inflation comes down.

Source: U.S. Bureau of Labor Statistics

The June jobs report showed that the unemployment rate had ticked up for two consecutive months to 4.1% — above where some Fed officials predicted the rate would be at the end of this year. This was seen as a positive early in July as it was supportive of a rate cut in September. However, the most recent reading showed that the unemployment rate marched higher in July to 4.3%, its highest level since October 2021. This brought recession fears back into the picture and small cap equities sold off given that they tend to be more sensitive to economic cycles.

Week Ahead…

The upcoming week will be a relatively light week in terms of economic releases.

The ISM non-manufacturing Purchasing Managers’ Index (PMI) will be released for the month of July, offering insights into the health of the overall services economy. A reading above 50 indicates the services sector is expanding, and a reading below 50 indicates the sector is contracting. Additionally, economists will be paying close attention to the weekly initial jobless claims reading. The previous reading was the highest since August 2023 as the labor market continues to show signs of softening.

Crude oil inventories and the count of active oil rigs will be released by the Energy Information Administration (EIA). Those readings will measure the weekly change in the number of barrels of commercial crude oil held by U.S. firms. The level of inventories influences the price of petroleum products, which can have an impact on inflation. The previous five weeks have shown signs of a continuous increase in demand due to readings being stronger than anticipated. Furthermore, the number of active rigs for the week will be released. The number has remained stagnant over the past two readings, which indicates the anticipated continuous demand. Economists will be watching to see if this trend continues.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.